What is KYC?

Having to go through the KYC verification is perfectly normal whenever you sign up to a bookmaker, e-Wallet, betting exchange or any other service within a range of online financial services.

Know your customer or KYC is a commonly used term for a set of guidelines that require companies to make an effort to verify the identity of their customers or clients.

Banks, digital payment service providers or financial firms are required to complete the customer’s KYC process before allowing them full access to all services.

The objective of the mandatory process is to prevent illegal activities such as businesses being used for money laundering, bribery or corruption.

KYC assists authorities and businesses to keep track of customer activity and detect fraudsters beforehand and also helps companies to keep fraudsters out of their systems.

Which documents are accepted?

As part of the KYC verification process, you will be asked to provide documentation that can verify your identity and your address.

For the identity verification you will be asked to submit one of the following documents:

Government-Issued Photo-Based Identity Card

Passport

Driver’s License

For the address verification you will normally be asked to submit one of the following documents:

Utility Bills

Bank Statement

Rent Agreement

Employer Letter

Insurance Agreement

Tax Bills

It is important to note that the documents must not be more than three months old.

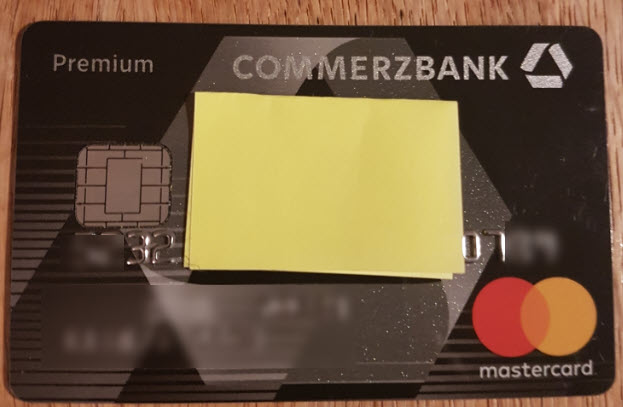

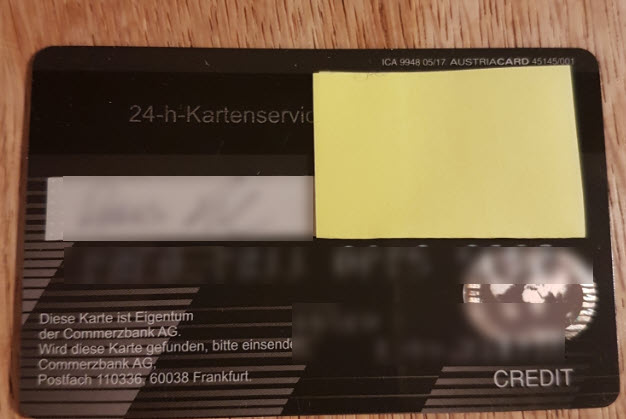

In addition, you may also be asked for proof of ownership of the payment method e.g. copy of your credit card.

Make sure you always cover your three-digit security number. This can be done with a little piece of paper as shown below.

Please note that the blur effect is only for the purpose of this guide.

As part of the KYC verification process, you will be asked to provide documentation that can verify your identity and your address.

For the identity verification you will be asked to submit one of the following documents:

Government-Issued Photo-Based Identity Card

Passport

Driver’s License

For the address verification you will normally be asked to submit one of the following documents:

Utility Bills

Bank Statement

Rent Agreement

Employer Letter

Insurance Agreement

Tax Bills

It is important to note that the documents must not be more than three months old.

In addition, you may also be asked for proof of ownership of the payment method e.g. copy of your credit card.

Make sure you always cover your three-digit security number. This can be done with a little piece of paper as shown below.

Please note that the blur effect is only for the purpose of this guide.

However, it is generally advisable not to hide too much information, as this increases the chances that your documents will be rejected. In particular, you should never hide dates, your full name and your address.

From the submitted documentation the following data is collected:

Full Name

Document Number

Address of Residence (For Address Verification)

Image of the Person

Date of Birth (Mostly needed for Age Verification)

Document Issue and Expiry Date

Nationality

How to submit the documentation

There are several ways to collect and submit documents.

Scan – Many people have a printer with a scan function.

Photo – You can also just take a photo with your mobile phone

Mobile app – There are a number of mobile scanner apps, where you can scan and compile several documents just like you would with a regular scanner. One such app is Tap Scanner (Use the free version).

In case you get an error message when trying to upload the documents and the size of the file you are trying to submit is larger than what is permitted, you can use a free online compressor service such as https://compressor.io/. Simply upload or drag and drop your image and the image will be compressed by 60% to 90% compared to its original size, without compromising the quality of the image.

Is my data safe?

Yes, your data is safe.

Companies like EcoPayz and Bet-Football are very strict about the data they collect.

A leak of private information would be a disaster for either company and would likely result in the company having to close down as it is almost impossible to regain the customers’ trust after such a data breach.

The same can be said about most bookmakers. A number of them are public companies and it is safe to assume that the stock prices would plummet if a data breach were discovered.

Conclusion

Know Your Customer or KYC is a standard way for companies to look into whether you are who you say you are.

Every bookmaker, e-Wallet, or other support function will ask for the same information.

By having the documentation ready (e.g. saved in a folder on your computer) at hand, you will save a lot of time.